This article is written for the case study of the course I enrolled

lately -

Google Data Analytics.

In this analytic article, I applied the methodology of Data Analytics that data analysts use to

solve problems, which are ASK, PREPARE, PROCESS, ANALYZE, SHARE and ACT, to investigate how severe COVID-19

affected

two listed financial institution’s performances throughout the period.

A clear statement of the business task you have selected to investigate

Business task:

COVID-19 has been spread over the world since 2019, a big strike was also given across different industries in

terms of their financial performance. Hence, I would like to use publicly disclosed financial data of two listed

financial institutions – Wells Fargo (NYSE: WFC) and Bank of America (NYSE: BAC) - to

investigate how severe

their earnings were affected by COVID-19 throughout the period.

Key stakeholders:

public, as this statement will be published on the internet

Dataset:

Self-developed dataset, based on the SEC filings these two companies uploaded on SEC website

(

https://www.sec.gov/

), which are stored as .xml files by XBRL language. A SQL database will be developed to

store the data parsed by python

[2]

, part of the script is referenced by sigma coding “Web Scraping the SEC”

[3] .

Data storage:

data has been generated and cleaned, the raw dataset and cleaned dataset have been stored on

Kaggle

[1] .

Data credibility:

Data used has been cross-checked with the financial reports of the two companies

Data organization:

Data scrapped as structured data and stored in SQL database, with metadata as follows:

| GAAP_code |

STRING |

The company's account codes according to GAAP regulation

|

| Amount |

INTEGER |

The amount of the account at the reporting period

|

| Year |

INTEGER |

Year of the reporting period

|

| CIK |

INTEGER |

CIK code of the company

|

| Company_Name |

STRING |

The company’s name

|

| Report_Code |

STRING |

Report codes according to SEC standard

|

| Ticker |

STRING |

Ticker code of the company

|

| Report_Date |

STRING |

The cut off date of the report

|

| Quarter |

INTEGER |

Quarter number of the reporting period

|

| Segment |

STRING |

Main segment or subsegment of the report

|

| UniqueID |

STRING |

A unique ID number used by SEC |

| Coverage |

STRING |

Year to date (YTD) or Quarter to date (QTD)

|

| Projection |

BOOLEAN |

Whether or not actual figures |

| Owner |

STRING |

Owner of the data |

Error check:

no significant errors detected

Tools used:

SQL, Microsoft Excel, RStudio

Data transformation:

data was extracted as .csv file in order to analyze by excel and import by RStudio easily

Data cleaning:

The data was cleaned by SQL script, which is stored on GitHub

[2].

The script deals with:

| 1) |

Filtered out duplicate data |

| 2) |

Added two computed columns -

Amount_QTD

and

Amount_QTD_pre

to facilitate further analysis

|

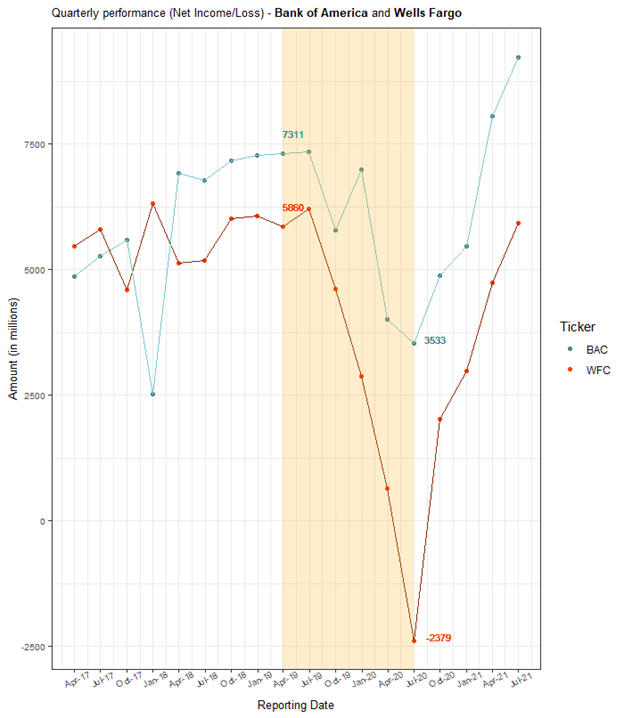

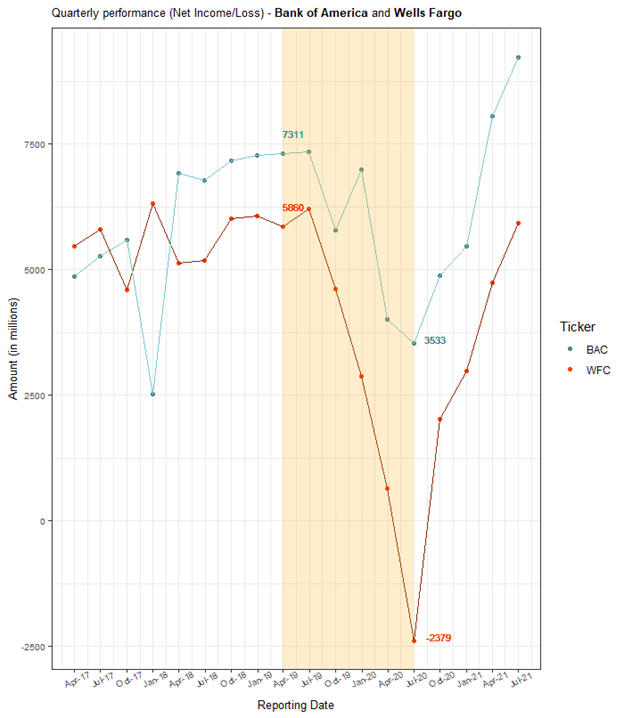

According to the data from their quarterly financial filings (i.e., 10-Q and 10-K) through plotting by RStudio

[2]

, it is clear to see, during COVID-19 season, which is ranged from Q1 2019 to Q2 2020 colored in yellow, both

companies suffered an apparent performance downturn.

Their performances declined from US$7,311M and US$5,860M to US$3,533M and -US$2,379 (or -51% and -141%)

respectively. However, the resilience of Bank of America (Ticker: BAC) was obviously almost three times (3x)

stronger than its competitor, Wells Fargo Bank (Ticker: WFC).

Moreover, it is believed the stronger resilience of Bank of America made himself to regain faster than Wells

Fargo in the post-COVID period, which can be seen from the chart that BAC’s earnings had already reached its

pre-COVID peak in Q4 2020, whereas WFC had not achieved this goal at the end of Q2 2021.

In conclusion, the impact of COVID-19 had influenced both US-based financial institutions negatively.

Nevertheless, these two companies handed out largely different results in terms of their profit-earning

capability. This could be due to different reasons, the most common could be management competency, customer

demography, asset quality etc.